Shares & Securities

Nicolaw1702

Registered Posts: 64 Regular contributor ⭐

Please can anybody:blushing: help, there is something I dnt understand on the June 2007 paper.

Section 2 , question 1,

Sophia sold 4,000 shares on 23 Feb 2008 for £36,200 , but in the answers it uses the 500 which were purchased March 2008? But this is after the shares were sold?

Please help

Section 2 , question 1,

Sophia sold 4,000 shares on 23 Feb 2008 for £36,200 , but in the answers it uses the 500 which were purchased March 2008? But this is after the shares were sold?

Please help

0

Comments

-

PTC ONLY

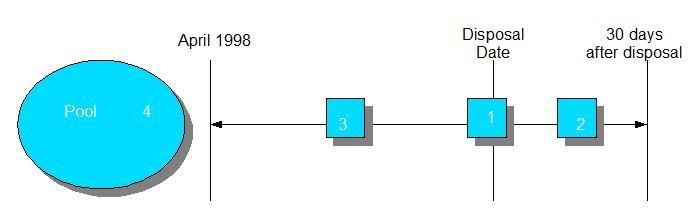

HMRC "matches" shares disposed of with those purchased in the following order:

1) Shares purchased on the same dayof the disposal.

2) Any shares bought 30 days after the disposal are matched with those disposed of (matching earliest first if more than one acquisition in 30 day period), e.g. shares bought 1 week after disposal matched before those purchased 3 weeks after.

3) Any shares bought between 6/4/1998 and the disposal date, working backwards in time on a last in, first out (LIFO) basis, e.g. shares bought in April 2000 will be matched before any bought in March 2000.

4) Remaining shares not yet matched are deemed to have come from F

the 'FA 1985 pool'.

This timeline should help you picture it:

In reference to the question, the shares purchased on 10 March fall within 30 days after the sale.0 -

this has confused me my textbook says- same day first, previous 9 days then pool? anyone know which is correct or am i confusing 2 different things?! gonna go back and read the original question now to make sure!!

x0 -

maybe your talking about personal tax and i'm talking business tax????0

-

I asked my tutor, and she said its as if its the end of year, so you would use the 500 from the March purchase. Just doesnt seem right , if you dispose of something in Feb, then the March purchase wouldnt have evn happened??

I think I am just confusing myself.:mad2:0 -

Nicolaw1702 wrote: »Just doesnt seem right , if you dispose of something in Feb, then the March purchase wouldnt have evn happened??

Admittedly so, but that is (one of) the share matching rules. It is known as the 'bed and breakfasting rule', and the reason why it was bought in is explained by HM Revenue & Customs in BN27 as:

"The bed and breakfasting rules are designed to prevent individuals and others within the charge to CGT disposing of shares or securities and acquiring identical ones shortly afterwards for the purpose of realising a capital gain free of tax (because it is covered by the annual exempt amount) or a capital loss (which can be set off against chargeable gains to reduce a tax liability) while still, in effect, holding on to the investment."

The rules are explained in full on HMRC HelpSheet 284: http://www.hmrc.gov.uk/helpsheets/hs284.pdf (at the bottom of page 2).0

Categories

- All Categories

- 1.3K Books to buy and sell

- 2.3K General discussion

- 12.5K For AAT students

- 390 NEW! Qualifications 2022

- 174 General Qualifications 2022 discussion

- 16 AAT Level 2 Certificate in Accounting

- 78 AAT Level 3 Diploma in Accounting

- 114 AAT Level 4 Diploma in Professional Accounting

- 8.9K For accounting professionals

- 23 coronavirus (Covid-19)

- 276 VAT

- 96 Software

- 281 Tax

- 149 Bookkeeping

- 7.2K General accounting discussion

- 211 AAT member discussion

- 3.8K For everyone

- 38 AAT news and announcements

- 345 Feedback for AAT

- 2.8K Chat and off-topic discussion

- 589 Job postings

- 16 Who can benefit from AAT?

- 37 Where can AAT take me?

- 43 Getting started with AAT

- 26 Finding an AAT training provider

- 48 Distance learning and other ways to study AAT

- 24 Apprenticeships

- 67 AAT membership