PTC Dec 08

Liliana

Registered Posts: 39 Regular contributor ⭐

Hi there

I am trying to get my head around shares and how are we meant to deal with them. My tutor only started this subject last week and guess what, the exam is next week... no need to say that everyone in the class is panicking due to the fact that we are not having enough time to learn this in time for the exam... very frustrating... anyway...

I have realised since i started this course at this college, that there is only one person that i can rely on, and that person is me and any other help that i might or not get.

Could anyone please clarify the matching rules and the pool rules and when are we meant to apply them? I have done the past paper dec 04 and jun 05 and both question 2.1 in each paper have the same question but the answer is completly different... please help!!!!

Thank you so much.

:confused1:

I am trying to get my head around shares and how are we meant to deal with them. My tutor only started this subject last week and guess what, the exam is next week... no need to say that everyone in the class is panicking due to the fact that we are not having enough time to learn this in time for the exam... very frustrating... anyway...

I have realised since i started this course at this college, that there is only one person that i can rely on, and that person is me and any other help that i might or not get.

Could anyone please clarify the matching rules and the pool rules and when are we meant to apply them? I have done the past paper dec 04 and jun 05 and both question 2.1 in each paper have the same question but the answer is completly different... please help!!!!

Thank you so much.

:confused1:

0

Comments

-

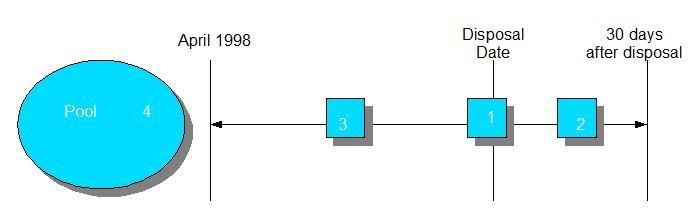

Share matching rules

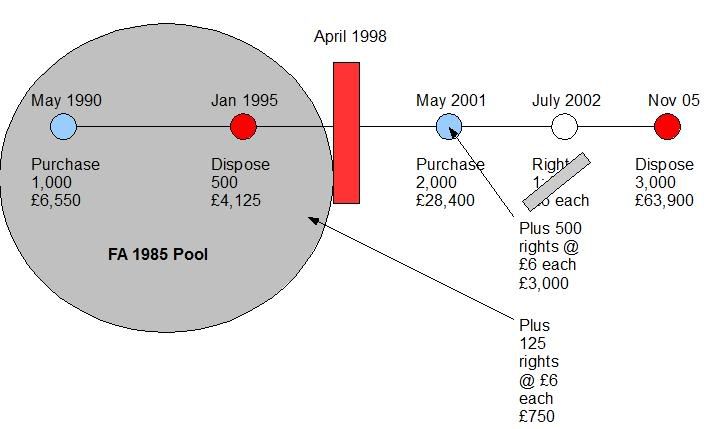

Diagram:

1. Firstly, any shares bought on the same day of the disposal are matched with the disposal.

2. Then any shares bought in the 30 days after disposal are matched on a FIFO basis (the ones bought soonest are matched first).

3. Then any shares bought between 6/4/98 and disposal date, working on a LIFO basis (matching latest purchases first).

4. Any remaining shares are deemed to have come from the FA1985 pool.

Rights and Bonus Issues

- Shares acquired via a Rights or Bonus issue are attached to their "parent" shares for identification purposes (both for Share Matching and Taper Relief).

- Any Rights or Bonus issues after April 1998 but relating to shares bought before April 1998 are just added to the end of the pool, and are not attached to each individual transaction before April 1998.Example:

March 2008 - Sold 120 shares

January 2007 - Bonus Issue of 1:5

February 2007 - Purchased 100 shares

Using the matching rules,

- No shares bought on same day, then

- No shares bought in following 30 days, then

- Working backwards until April 1998, most recent acquisition is bonus issue, where we acquired 20 shares. However, as the bonus issue is dependent on previous acquisitions, we treat this as a "ghost town", if you see what I'm getting at, where the people have fled back to their parents, which will be

- the February 2000 purchase. All 120 shares (100 purchased, plus 20 bonus) are deemed to come from here, once the gain is calculated, it will be charged on 7 complete years of ownership

The FA 1985 Pool

General

- The pool is made up of three columns: 1) No. of shares, 2) Unindexed cost, and 3) Indexed cost.

- Once the pool is set up with the initial transaction, every operative event will give rise to indexation. Also, as indexation finishes in April 1998, shares must be indexed to then.

- An operative event occurs whenever shares with a value enter or leave the pool.

- We must first index up the indexed column from the time of the last rise before adding or subtracting value to or from the pool.

Bonus and Rights issues

- A bonus issue is not an operative event. Only the number of shares is increased, no money is paid for acquisition.

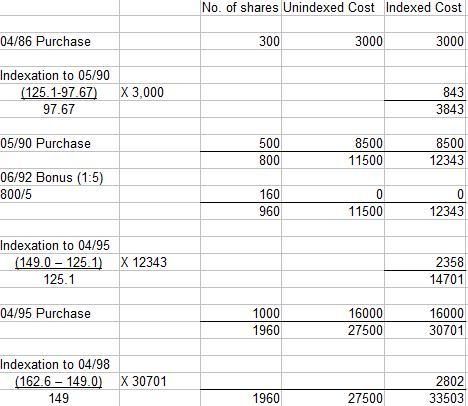

- A rights issue is an operative event as money is paid for the shares.Example (Taken from another thread)

April 1986 Purchased 300 shares £3,000

May 1990 Purchased 500 shares £8,500

June 1992 Bonus Issue 1 for 5

April 1995 Purchased 1,000 shares £16,000

March 2004 Sold 400 shares £7,600

In Jan 2008 we sold all shares for £65,000

First, check the share matching rules and apply them to the scenario.

1. Same day acquisitions - none

2. Acquisitions in the following 30 days on a FIFO basis - none

3. Acquisitions after 6-4-98 on a LIFO basis - none

4. FA1985 pool - shares acquired between 6-4-82 and 5-4-98 (also known as Section 104) - Yes

The FA1985 pool for this scenario (all figures to nearest £):

We now have to do the calculations for the 2004 disposal of 400 shares. The cost and indexation is based on an average of the final pool totals:

- the cost of the shares equals £5,612 (£27500/1960 shares owned, then multiplied by the 400 sold)(to nearest £)

- the indexation allowance is calculated by firstly calculating the indexed cost of the 400 shares disposed, which is £6,837 (£33503/1960, multiplied by 400), then deducting the cost from this (£5,612) to give you £1,225.

The gain on this sale therefore is:

Proceeds = 7,600

Less Cost = (5,612)

Less I. A. = (1,225)

GAIN BEFORE T.R = 763

There are 5 complete years between April 1998 and March 2004, plus 1 bonus year as the assets were owned before the removal of Indexation Allowance was announced, therefore the gain is 80% chargeable, based on 5 + 1 years.

Gain after Taper = £610

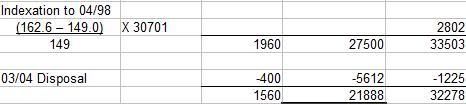

We now adjust the bottom of the FA1985 pool as follows:

As we are now selling all shares, simply take the figures from the bottom row and put them in your computation

Proceeds = 65,000

Less Cost = (21,888)

Less I. A. = (10,390)

GAIN BEFORE T.R = 32,722

There are 9 complete years between April 1998 and January 2008, plus 1 bonus year as the assets were owned before the removal of Indexation Allowance was announced, therefore the gain is 60% chargeable, based on 9 + 1 years.

Gain after Taper = £19633

Finally, you would deduct these from your pool, leaving a final line of zeroes as all shares are sold.0 -

Shares/Charles Munger

My friend has been having trouble with shares, and although I think that I have sorted her problem, your reply is so good that I would like to email it to her. She is an AAT student member, as I am, but whether I can talk her into the right page or not to see your reply is doubtful. Is it allowed to email it to her? and if it is would you mind - ecklington0 -

No problem with me whatsoever.0

-

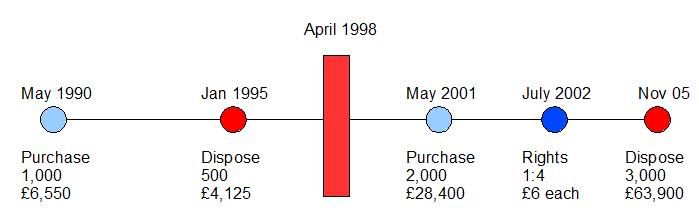

After a pm request from confoosed asking to work out the following question, I thought I'd put it here so more people can see it.

Question:Purchases:

May 1990 1000 £6,550

May 2001 2000 £28,400

July 2002 Rights Issue, 1 for 4 £6 each

Disposals

Jan 1995 500 £4,125

Nov 2005 3000 £63,900

Answer

First place to start with a share matching question (and also for a part-PPR question) is with a timeline of the events, like this:

The next thing I'd do is work out how many shares were acquired at the rights issue.

As said before, the rights issue shares are attached to their "parents", so it is advisable to do a seperate working for each "parent".

In the question, there are two "parents"; the May 2001 purchase, and the FA1985 pool (incorporating the May 1990 purchase and the Jan 1995 disposal).

2,000 shares were purchased in May 2001, and none of these were disposed before the November 2005 disposal, so 500 rights (2,000/4) are attached to this purchase.

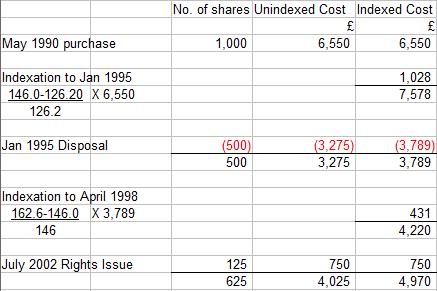

At the close of the pool in April 1998, there are 500 shares in the pool (1,000 purchased less 500 disposed), so 125 rights (500/4) are attached to this purchase.

Your timeline should now look like this (click it for full size image)

Now, we share match using the rules:

1) Same day acquisitions - no.

2) Acquisitions in the following 30 days - no.

3) Acquisitions between disposal date and 6/4/98 - yes.

If we travel backwards from the disposal date, first acquisition we hit is the rights issue in July 2002. However, there aren't any shares here. So instead, we carry on along the line until we get to May 2001.

Here, we have a purchase, plus the rights issue shares. The total number of shares here are 2,500, which will account for the bulk (but not all) shares disposed in November 2005. So we must carry on traveling along the line.

The next event we get to is April 1998. At this point, we are plunged into the FA1985 pool, where the remainder of the shares sold must lie.

So, now we know that of the 3,000 shares sold in November 2005:

- Share Matching 1: 2,500 are matched against the May 2001 purchase, and

- Share Matching 2: the remaining 500 lie in the FA 1985 pool.

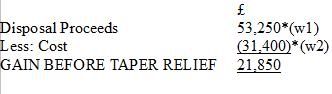

Therefore, we will have two seperate workings (one for each matching) and two seperate capital gains.Gain/Loss from Share Matching 1

*w1: (£63,900/3,000) x 2,500

*w2: £28,400 + (500 shares x £6/share) = £28,400 + £3,000

There are 4 complete years of ownership between May 2001 and November 2005, therefore the gain will be chargeable at 90%Gain/Loss from Share Matching 2

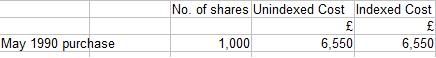

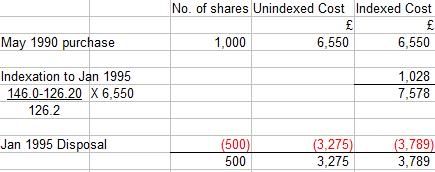

We start the FA 1985 pool with the initial purchase, the May 1990 purchase of 1,000 shares.

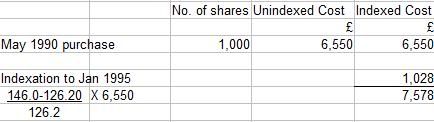

The next event to happen is the Jan 1995 disposal. Before we enter the figures for the shares disposed of, we must index the cost

Now, we deduct the cost and indexed cost of the shares disposed,

WORKINGS:

Cost: £6,550/1,000 shares x 500 shares = £3,275

Indexed Cost: £7,578/1,000 shares x 500 shares = £3,789

and deduct this from the pool

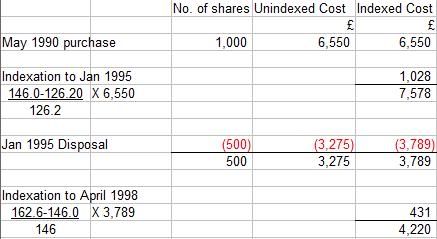

Then we index to April 1998

Then we add the shares acquired in the July 2002 purchase

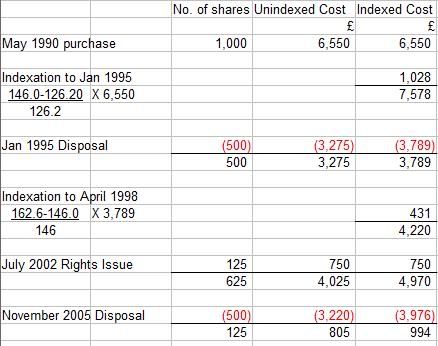

We then calculate the cost and the indexed cost of the shares disposed in November 2005

Cost: £4,025/625 shares x 500 shares = £3,220

Ind. Cost: £4,970/625 shares x 500 shares = £3,976

and deduct these from our pool

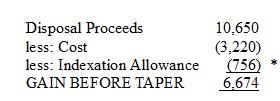

Now that we have finished our pool, we can calculate the Capital Gain from Share Matching 2:

* Indexation Allowance = Indexed Cost less Cost = £3,976 - £3,220 = £756

There are 7 complete years of ownership between April 1998 and November 2005, plus a bonus year for ownership before 17/03/98, therefore the gain will be chargeable at 70%0

Categories

- All Categories

- 1.3K Books to buy and sell

- 2.3K General discussion

- 12.5K For AAT students

- 390 NEW! Qualifications 2022

- 174 General Qualifications 2022 discussion

- 16 AAT Level 2 Certificate in Accounting

- 78 AAT Level 3 Diploma in Accounting

- 114 AAT Level 4 Diploma in Professional Accounting

- 8.9K For accounting professionals

- 23 coronavirus (Covid-19)

- 276 VAT

- 96 Software

- 281 Tax

- 149 Bookkeeping

- 7.2K General accounting discussion

- 211 AAT member discussion

- 3.8K For everyone

- 38 AAT news and announcements

- 345 Feedback for AAT

- 2.8K Chat and off-topic discussion

- 589 Job postings

- 16 Who can benefit from AAT?

- 37 Where can AAT take me?

- 43 Getting started with AAT

- 26 Finding an AAT training provider

- 48 Distance learning and other ways to study AAT

- 24 Apprenticeships

- 67 AAT membership