Some finer detail - can you help? AQ2016 Ptax

Lindi

Registered Posts: 166

in Personal Tax

I've reached a point of confusion and mixed signals between reference books and college and have no tutor to ask. Can you help with a few points which I'm unsure about?

* CGT Share Pool - one of the rules of the pool is disposals made within 30 days of acquisition - can this be 30 days prior AND 30 days after or is it only after?

* Income tax, I learnt that a bonus is only taken into account from the date on which you became entitled to it. There are usually three steps: determined, entitled and paid. Am I correct in thinking if the entitled date falls within the assessed tax year then you use that?

* Insurance on property income - if a property is only rented for some months during the assessable tax year, it has to be time apportioned. Is this the same for insurance for the property? Eg. if a property was only rented for 8 months yet insured for 10 can you claim all 10 months of insurance as an allowable deduction?

* Finally, rounding. I'm having a real struggle with rounding here, everyone does it different. I've only just switched over to rounding down to the nearest pound and now answers are out as they're rounding up. Is there a steadfast rule? It's computer marked so I'd hate to get it wrong due to rounding and I'm not convinced AAT will make it completely clear.

Thank you for reading, if anyone can shed some light on this I'd really appreciate it as I've said we've no tutor to ask any longer, she has left the college and no replacement. :-(

* CGT Share Pool - one of the rules of the pool is disposals made within 30 days of acquisition - can this be 30 days prior AND 30 days after or is it only after?

* Income tax, I learnt that a bonus is only taken into account from the date on which you became entitled to it. There are usually three steps: determined, entitled and paid. Am I correct in thinking if the entitled date falls within the assessed tax year then you use that?

* Insurance on property income - if a property is only rented for some months during the assessable tax year, it has to be time apportioned. Is this the same for insurance for the property? Eg. if a property was only rented for 8 months yet insured for 10 can you claim all 10 months of insurance as an allowable deduction?

* Finally, rounding. I'm having a real struggle with rounding here, everyone does it different. I've only just switched over to rounding down to the nearest pound and now answers are out as they're rounding up. Is there a steadfast rule? It's computer marked so I'd hate to get it wrong due to rounding and I'm not convinced AAT will make it completely clear.

Thank you for reading, if anyone can shed some light on this I'd really appreciate it as I've said we've no tutor to ask any longer, she has left the college and no replacement. :-(

0

Comments

-

Another one I can throw out there is extensions to property on CGT. It says somewhere that if an extension was added to a property in a previous tax year to the assessable one then you can add it to the value of the house when calculating gain. Is this correct according to AAT?0

-

Hi @Lindi

I'll answer your questions separately in case I'm called away midway.

No only 30 days after.Lindi said:* CGT Share Pool - one of the rules of the pool is disposals made within 30 days of acquisition - can this be 30 days prior AND 30 days after or is it only after-

I remember the matching rules as:

1) SAME day

2) NEXT 30 days

3) SHARE POOL

1 -

Yes. It is the earlier of date of receipt and date the employee is entitled to the bonus. So if entitlement date falls within 2016/17 but paid later include bonus in 2016/17 computation.Lindi said:* Income tax, I learnt that a bonus is only taken into account from the date on which you became entitled to it. There are usually three steps: determined, entitled and paid. Am I correct in thinking if the entitled date falls within the assessed tax year then you use that?

0 -

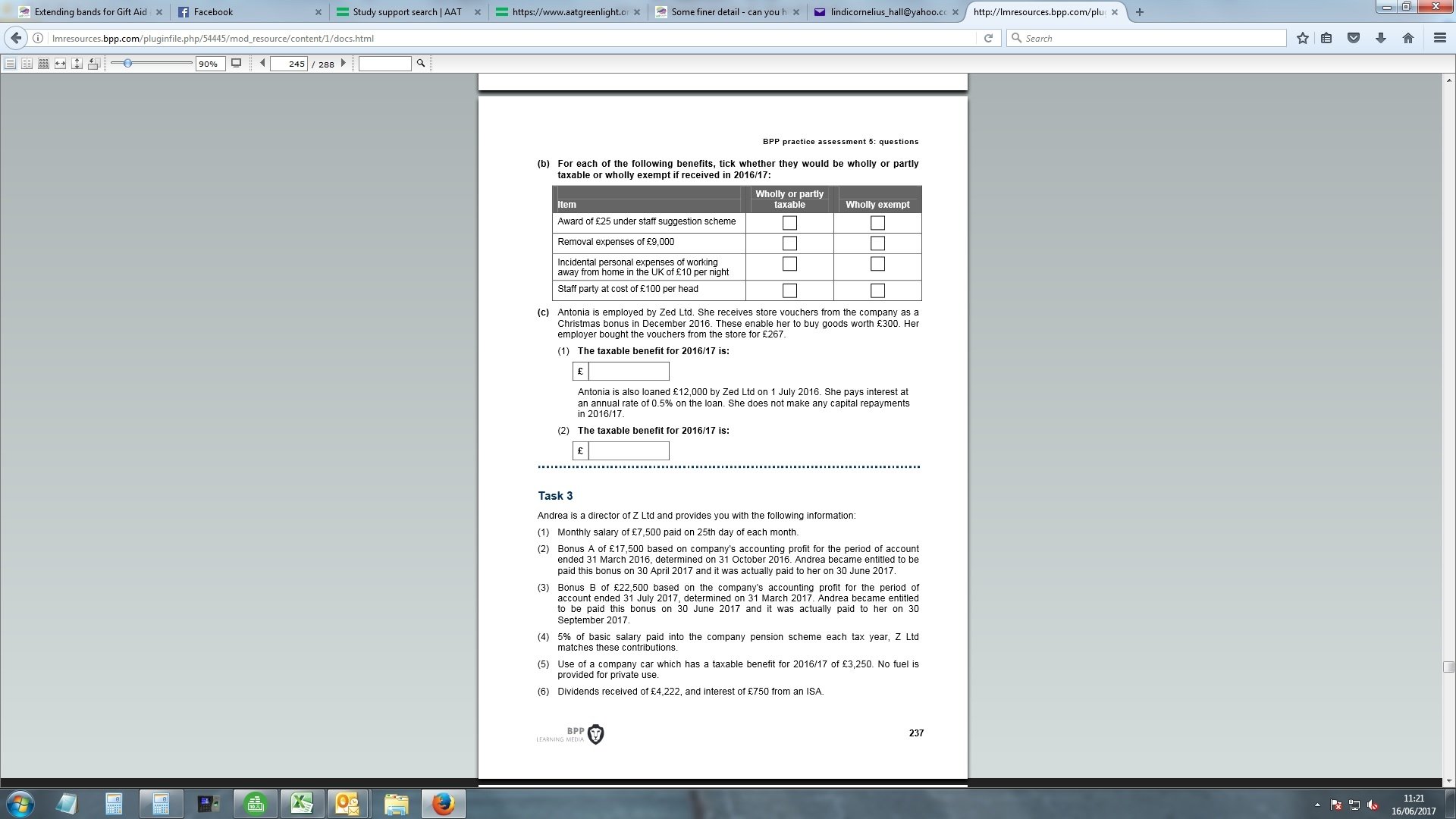

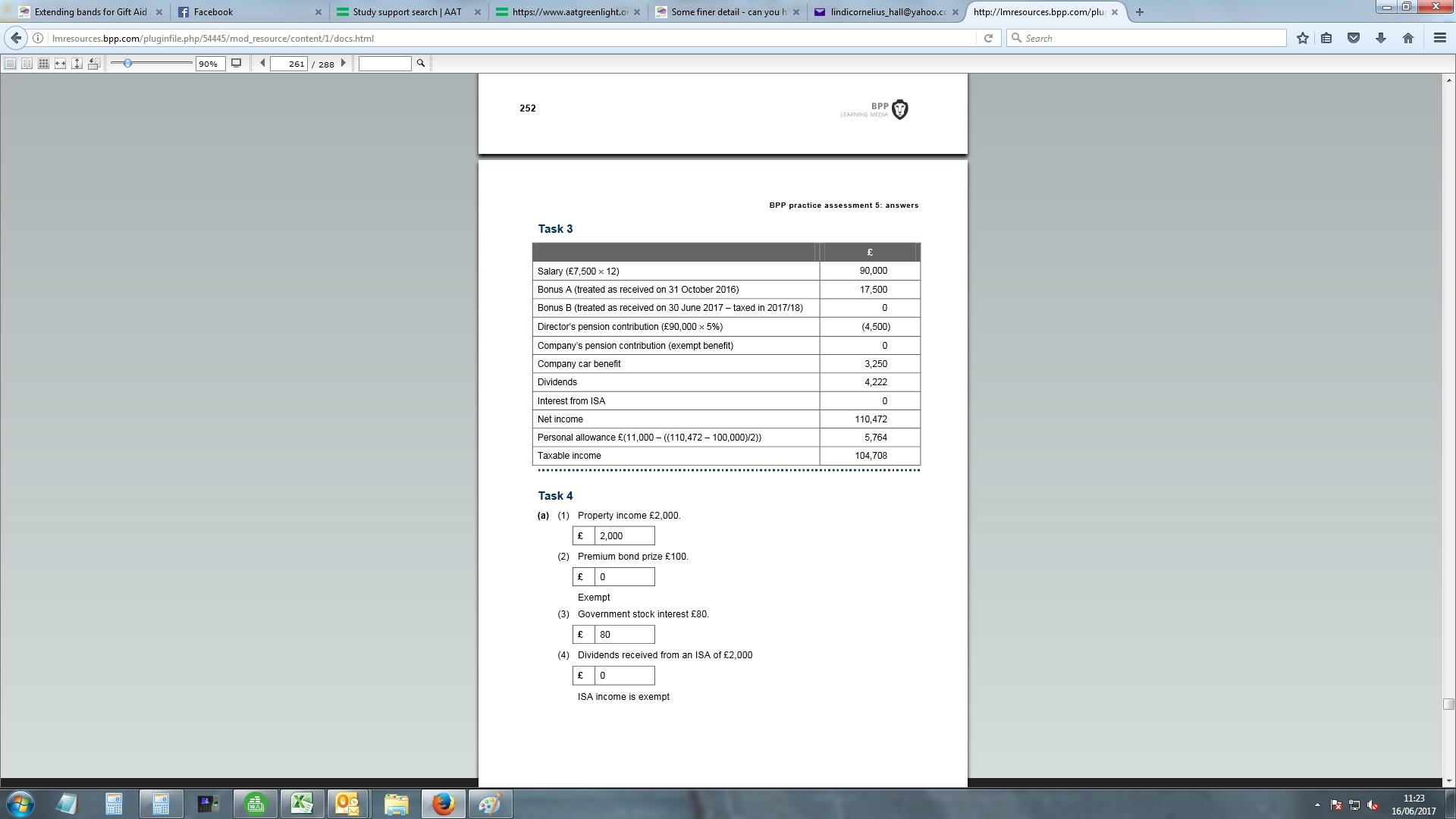

Ahh potential error in BPP then. Look at Bonus A in Task 3

And here is the answer, they have used the date Bonus A was determined not entitled.

0 -

* Insurance on property income - if a property is only rented for some months during the assessable tax year, it has to be time apportioned. Is this the same for insurance for the property? Eg. if a property was only rented for 8 months yet insured for 10 can you claim all 10 months of insurance as an allowable deduction?

As long as they (the owner/landlord) are not living in the property and still own it then they would be able to claim the full 10 months insurance

* Finally, rounding. I'm having a real struggle with rounding here, everyone does it different. I've only just switched over to rounding down to the nearest pound and now answers are out as they're rounding up. Is there a steadfast rule? It's computer marked so I'd hate to get it wrong due to rounding and I'm not convinced AAT will make it completely clear.

The official rule for tax is round in favour of the tax payer (Tax - Round down, Allowances - Round up) In the AAT exams they will except rounding up or down as they aren't looking to see if you can round a number to the nearest penny but assessing if you understand the tax process. I believe it says this on the first page of the assessments (Practice ones too)

AAT Level 2&3 - 2016

AAT Level 4 - 2017

Personal Tax, Business Tax and External Auditing

ACA/CTA -

Certificate Level - Jan 20191 -

Insurance on property - I was going to add that I had only come across questions that required adjusting for private use so your clarification helped me too.

Rounding - I always round up unless told to do otherwise but have come across answers in BPP that round up on one answer and round down for another within the same question.

Thanks @CSan89 and also @Lindi for asking the questions as your points are useful for my revision.

1 -

Thanks everyone, just the last one left to answer on CGT - any takers?1

-

Do you know, on IHT, does the NRB replenish every 7 years?0

-

Yes to the CGT question1

-

I have one more little question on CGT please? Once again I'm facing some conflicting information between reference books on CLT. If you make a CLT to a trust, more than 7 years ago, can it still affect your NRB? One book says yes and the other says ignore CLT's over 7 years. I know that PET's become fully exempt after 7 years just not sure about CLT.

Have my live exam on Wednesday, so you're nearly rid of me

Appreciate your help. 0

0

Categories

- All Categories

- 1.3K Books to buy and sell

- 2.3K General discussion

- 12.5K For AAT students

- 390 NEW! Qualifications 2022

- 174 General Qualifications 2022 discussion

- 16 AAT Level 2 Certificate in Accounting

- 78 AAT Level 3 Diploma in Accounting

- 114 AAT Level 4 Diploma in Professional Accounting

- 8.9K For accounting professionals

- 23 coronavirus (Covid-19)

- 276 VAT

- 96 Software

- 281 Tax

- 148 Bookkeeping

- 7.2K General accounting discussion

- 211 AAT member discussion

- 3.8K For everyone

- 38 AAT news and announcements

- 345 Feedback for AAT

- 2.8K Chat and off-topic discussion

- 589 Job postings

- 16 Who can benefit from AAT?

- 37 Where can AAT take me?

- 43 Getting started with AAT

- 26 Finding an AAT training provider

- 48 Distance learning and other ways to study AAT

- 24 Apprenticeships

- 67 AAT membership