URGENT Sample ass 1 task 7

fedemenni

Registered Posts: 93

Would someone help me on the calculation of this?

A company has five year loan of £500k and overdraft of £50k, shareholder funds are £1500k

calculate the gearing ratio:

I do 500000/1500000x100 = 33.33% but the actual answer is 26.83%. I presume that £50k overdraft isn't a long term debt so I can't include it..

Please help .

thanks

Fred

A company has five year loan of £500k and overdraft of £50k, shareholder funds are £1500k

calculate the gearing ratio:

I do 500000/1500000x100 = 33.33% but the actual answer is 26.83%. I presume that £50k overdraft isn't a long term debt so I can't include it..

Please help .

thanks

Fred

0

Comments

-

I have found another topic about this: https://forums.aat.org.uk/Forum/discussion/444599/gearing-ratio0

-

It's calculated as total debt / total debt plus equity so total debt of 550 (500+50) divided by 2050 (500+50+1500) x 100% = 26.83%.

I found gearing confusing as it was calculated differently in different modules / textbooks! Some included the overdraft while others didn't....

Hope this helps!0 -

thanks scamp83, I didnt think about of adding the actual loan into the equity..

I have the exam today in few hours and I don't think I will pass, my brain has been playing up recently and can't even do 2% of 1000 sometimes0 -

You'll be fine, just try and relax and it will all come to you when you're in the exam :-)0

-

hopefully! this level 4 has been a disaster in all fronts.. this supposed to be my last exam and finish but didnt pass FSLC, MDCL and didnt even sit the PDSY. So far passed just MABU, and awaiting response for ETAU ..

previous years finished with all exams passed at the first time 0

previous years finished with all exams passed at the first time 0 -

Yeah it's been awful hasn't it! I managed to scrape through PDSY and only passed the MDCL because of the uplift....I can't face moving onto any other study for the time being, this last year has wiped me out!1

-

yeah just awful and having to wait 6+ weeks doesn't help at all!0

-

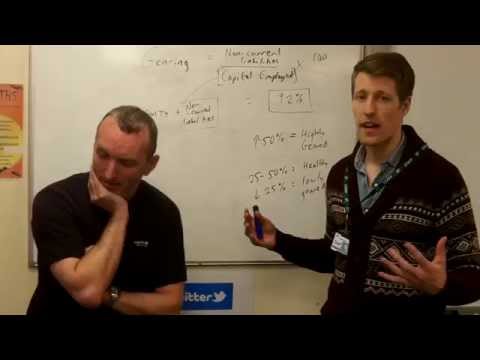

btw my formula is wrong, should be non current liabilities / capital employed x 100, instead i thought that it would have been non current liabilities / equity x 1000

-

this is a nice video:

https://www.youtube.com/watch?v=5Ulii9vxQGc 0

https://www.youtube.com/watch?v=5Ulii9vxQGc 0 -

I found it useful to go into the study material section for the 2013 standards and look at the performance feedback reports from AAT - they detail the most common errors that students make. These aren't yet available for AQ2016 but they are still good for knowing the common pitfalls.1

Categories

- All Categories

- 1.3K Books to buy and sell

- 2.3K General discussion

- 12.5K For AAT students

- 390 NEW! Qualifications 2022

- 174 General Qualifications 2022 discussion

- 16 AAT Level 2 Certificate in Accounting

- 78 AAT Level 3 Diploma in Accounting

- 114 AAT Level 4 Diploma in Professional Accounting

- 8.9K For accounting professionals

- 23 coronavirus (Covid-19)

- 276 VAT

- 96 Software

- 281 Tax

- 148 Bookkeeping

- 7.2K General accounting discussion

- 211 AAT member discussion

- 3.8K For everyone

- 38 AAT news and announcements

- 345 Feedback for AAT

- 2.8K Chat and off-topic discussion

- 589 Job postings

- 16 Who can benefit from AAT?

- 37 Where can AAT take me?

- 43 Getting started with AAT

- 26 Finding an AAT training provider

- 48 Distance learning and other ways to study AAT

- 24 Apprenticeships

- 67 AAT membership