Budgeting assessment 1, task 3

dumutroba

Registered Posts: 262

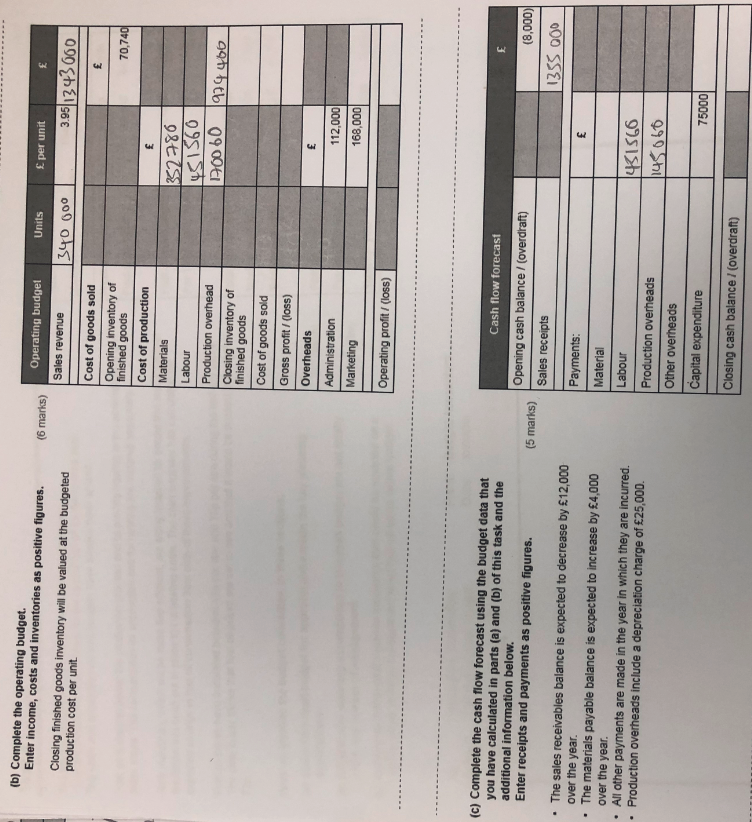

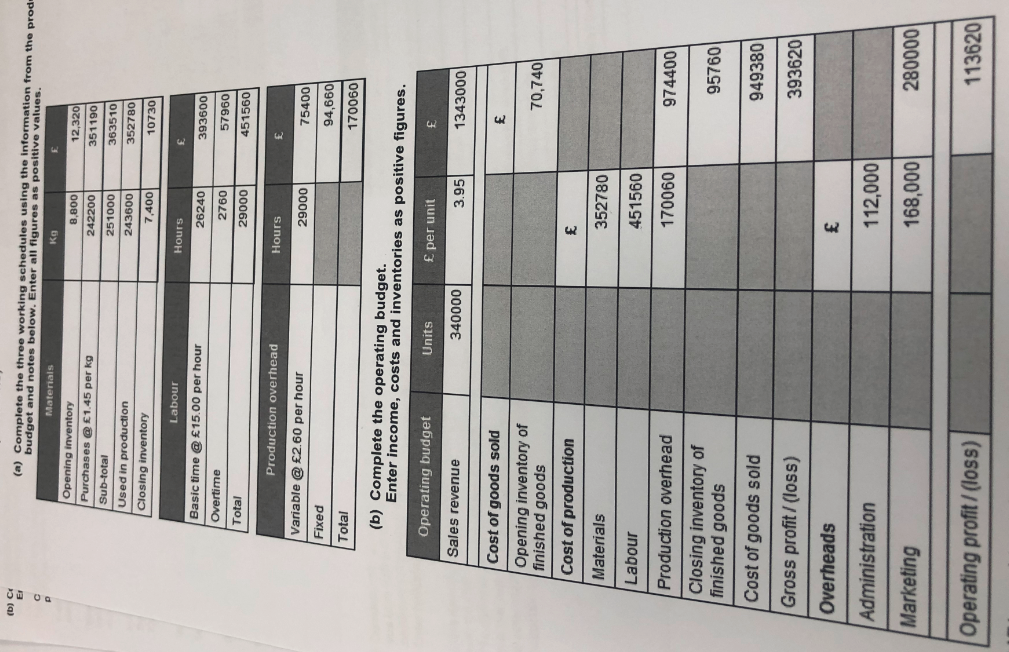

Solution

AAT Level 2. 2018 Distinction

AAT Level 3. 2018 Distinction

AAT Level 4. 2019 FSLC 100% MABU 93% MADC 82% PDSY 80%

Xero Certified Advisor

AAT Level 3. 2018 Distinction

AAT Level 4. 2019 FSLC 100% MABU 93% MADC 82% PDSY 80%

Xero Certified Advisor

1

Comments

-

@dumutroba thank you so much for this.dumutroba said:Solution

5 -

@dumutroba how do i work out the overtime part?sophie_612 said:0 -

Produced units x times taken to produce one unit

348000x5/60=29000h required

29000h-26240=2760h will be overtimeAAT Level 2. 2018 Distinction

AAT Level 3. 2018 Distinction

AAT Level 4. 2019 FSLC 100% MABU 93% MADC 82% PDSY 80%

Xero Certified Advisor0 -

.5

-

@dumutroba thank you so much i really appreciate your help, i'm struggling with this unit i just cannot seem to get my head around itdumutroba said:Produced units x times taken to produce one unit

348000x5/60=29000h required

29000h-26240=2760h will be overtime5 -

i just need a little help with part b and c of this question, i've started filling it out but i don't get how the have worked out some of the answers @dumutroba0

-

i just need a little help with part b and c of this question, i've started filling it out but i don't get how the have worked out some of the answers @dumutroba0

-

i just need a little help with part b and c of this question, I've started filling it out but i don't get how the have worked out some of the answers @dumutroba i've posted images to your wall as it will not let me upload0

-

0 -

0 -

Budgeted production cost per unit will be

Budgeted production cost /number of units, or £97440/348000=£2.80

Closing inventory is 34200 units, therefore £2.80x34200=£95760

Cost of goods sold is opening inventory +production overheads - closing inventory

The rest of it just followsAAT Level 2. 2018 Distinction

AAT Level 3. 2018 Distinction

AAT Level 4. 2019 FSLC 100% MABU 93% MADC 82% PDSY 80%

Xero Certified Advisor0 -

@dumutroba where did you get the 97440, how do you work that figure out?dumutroba said:Budgeted production cost per unit will be

Budgeted production cost /number of units, or £97440/348000=£2.80

Closing inventory is 34200 units, therefore £2.80x34200=£95760

Cost of goods sold is opening inventory +production overheads - closing inventory

The rest of it just follows

0 -

It should say 974,400, this is matrial, labour and production overhead costs combinedAAT Level 2. 2018 Distinction

AAT Level 3. 2018 Distinction

AAT Level 4. 2019 FSLC 100% MABU 93% MADC 82% PDSY 80%

Xero Certified Advisor0

Categories

- All Categories

- 1.3K Books to buy and sell

- 2.3K General discussion

- 12.5K For AAT students

- 390 NEW! Qualifications 2022

- 174 General Qualifications 2022 discussion

- 16 AAT Level 2 Certificate in Accounting

- 78 AAT Level 3 Diploma in Accounting

- 114 AAT Level 4 Diploma in Professional Accounting

- 8.9K For accounting professionals

- 23 coronavirus (Covid-19)

- 276 VAT

- 96 Software

- 281 Tax

- 148 Bookkeeping

- 7.2K General accounting discussion

- 211 AAT member discussion

- 3.8K For everyone

- 38 AAT news and announcements

- 345 Feedback for AAT

- 2.8K Chat and off-topic discussion

- 589 Job postings

- 16 Who can benefit from AAT?

- 37 Where can AAT take me?

- 43 Getting started with AAT

- 26 Finding an AAT training provider

- 48 Distance learning and other ways to study AAT

- 24 Apprenticeships

- 67 AAT membership