Personal Tax - NIC contributions question

VijiVijins

Registered Posts: 9

in Personal Tax

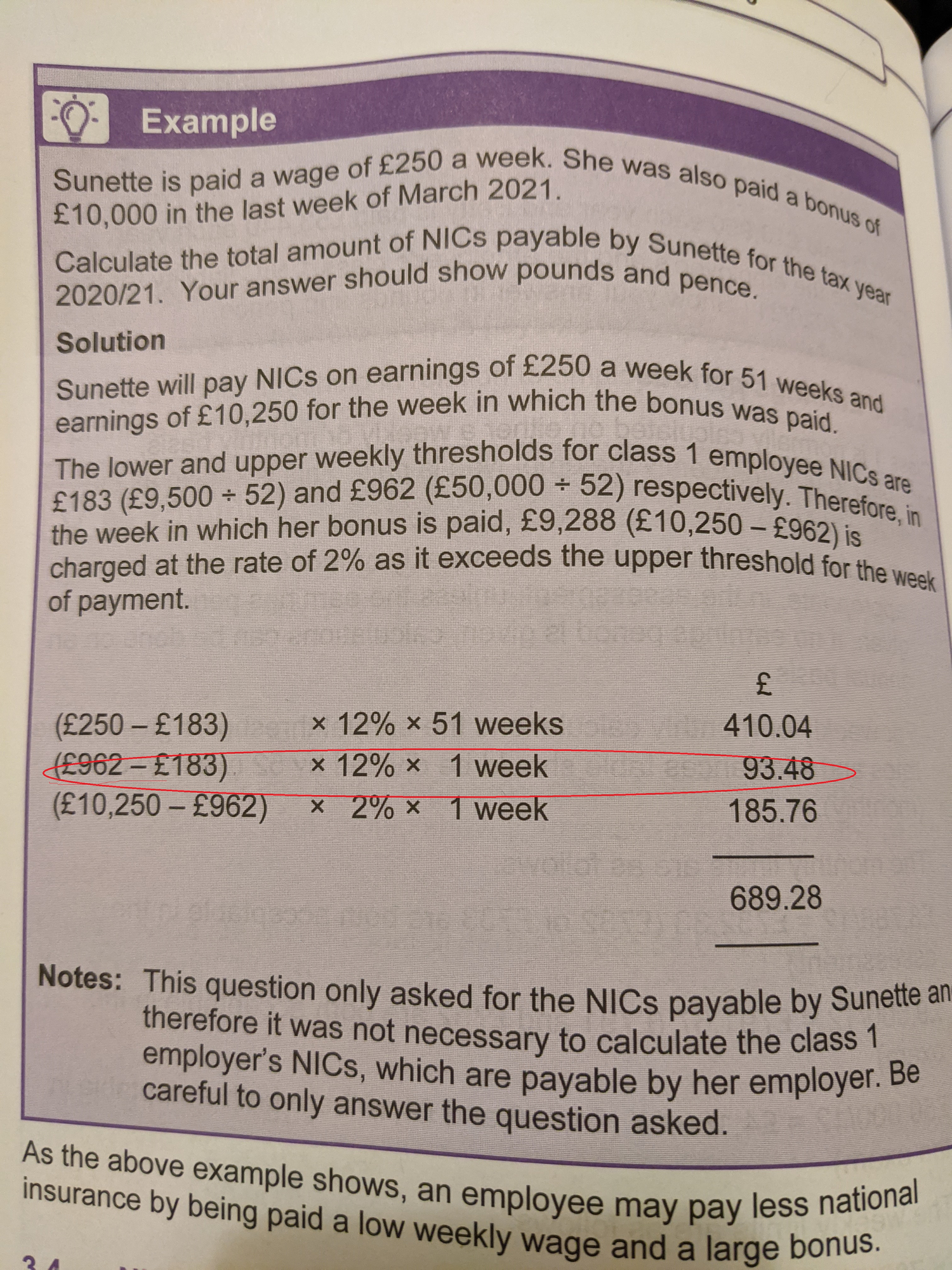

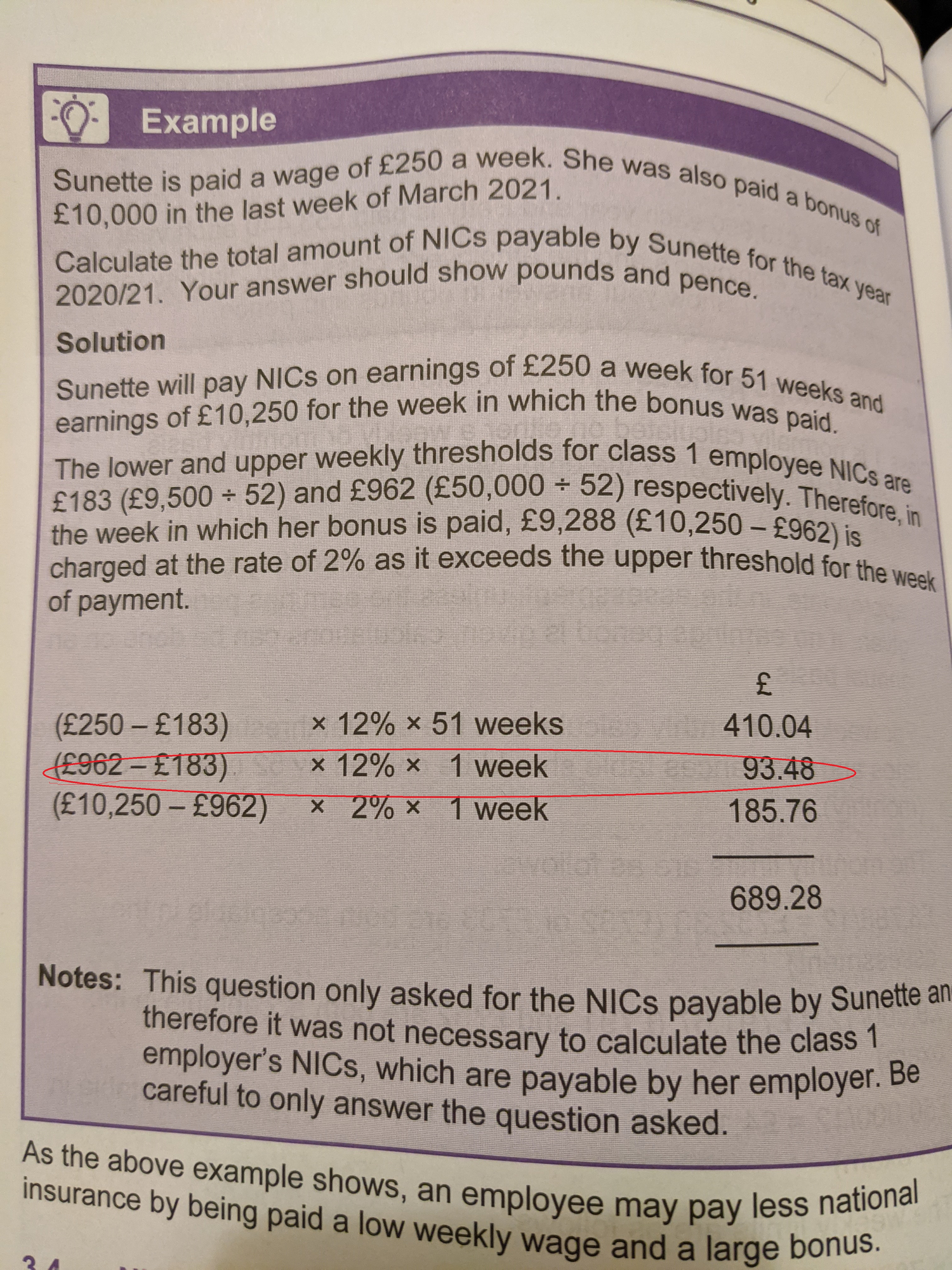

Hi guys, wonder if you could help me with the attached please. It is from Kaplan Personal Tax book.

I dont understand what (£962-£183 ) x 12% x 1 week relates to.

I dont understand what (£962-£183 ) x 12% x 1 week relates to.

0

Comments

-

It's to do with the weekly threshold for NI. You pay £0 NI on the first £183 a week 12% up to £962 a week.

So the NI on the bonus in the last week is:

(£183 - £0)*0*1 (number of weeks applied)

(£962-£183) * 12% * 1 =93.48

(£10250-£962) * 2 * 1 = 185.76

The income for the other weeks doesn't reach this threshold so only goes up to the £250 that is receivedAAT Level 4, MAAT

ACCA in progress

F4- Passed Aug 2020

F5- Passed Dec 2020

F6- Passed Sep 2020

F7- Passed June 2021

F8 - Passed Sep 2021

F9 - Passed June 2021

SBL -

SBR - Passed Mar 22

ATX - Passed Dec 21

APM - Passed June 220 -

Piant32, many thanks!0

Categories

- All Categories

- 1.3K Books to buy and sell

- 2.3K General discussion

- 12.5K For AAT students

- 390 NEW! Qualifications 2022

- 174 General Qualifications 2022 discussion

- 16 AAT Level 2 Certificate in Accounting

- 78 AAT Level 3 Diploma in Accounting

- 114 AAT Level 4 Diploma in Professional Accounting

- 8.9K For accounting professionals

- 23 coronavirus (Covid-19)

- 276 VAT

- 96 Software

- 281 Tax

- 148 Bookkeeping

- 7.2K General accounting discussion

- 211 AAT member discussion

- 3.8K For everyone

- 38 AAT news and announcements

- 345 Feedback for AAT

- 2.8K Chat and off-topic discussion

- 589 Job postings

- 16 Who can benefit from AAT?

- 37 Where can AAT take me?

- 43 Getting started with AAT

- 26 Finding an AAT training provider

- 48 Distance learning and other ways to study AAT

- 24 Apprenticeships

- 67 AAT membership