Personal Tax: Practice Assessment 2 Question 1:9

KAF

Registered Posts: 32

in Personal Tax

Hi,

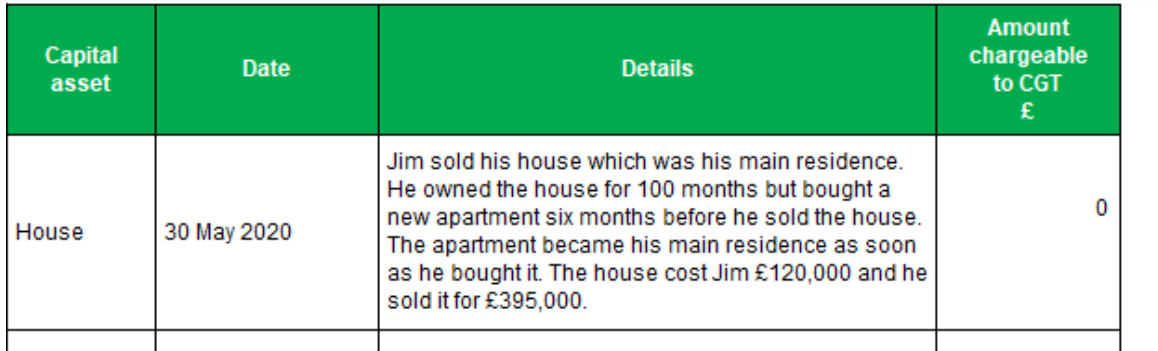

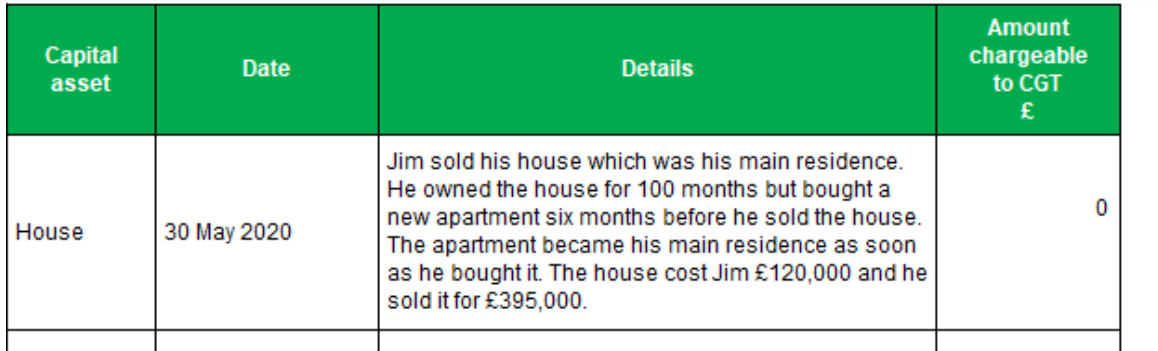

Could somebody assist on the question about the house. I'm a bit confused as to why its 0. I thought the calculation would be PPR so 395,000 - 120,000 = 275000 x deemed residence / total ownership period. Any help would be appreciated.

Could somebody assist on the question about the house. I'm a bit confused as to why its 0. I thought the calculation would be PPR so 395,000 - 120,000 = 275000 x deemed residence / total ownership period. Any help would be appreciated.

0

Comments

-

It will be nil because the house has always been his main residence apart from the last 6 months which will still qualify for relief because the last 9 months (previously 18) under these circumstances count0

-

The equation you've used is slightly wrong.

Capital gain * (1 - deemed residence / total ownership) is what you wanted or

Capital gain * (deemed non resident / total ownership)

Combine that with what douglas said and the deemed residence = total ownership.

Capital gain * 0 = 0AAT Level 4, MAAT

ACCA in progress

F4- Passed Aug 2020

F5- Passed Dec 2020

F6- Passed Sep 2020

F7- Passed June 2021

F8 - Passed Sep 2021

F9 - Passed June 2021

SBL -

SBR - Passed Mar 22

ATX - Passed Dec 21

APM - Passed June 220

Categories

- All Categories

- 1.3K Books to buy and sell

- 2.3K General discussion

- 12.5K For AAT students

- 390 NEW! Qualifications 2022

- 174 General Qualifications 2022 discussion

- 16 AAT Level 2 Certificate in Accounting

- 78 AAT Level 3 Diploma in Accounting

- 114 AAT Level 4 Diploma in Professional Accounting

- 8.9K For accounting professionals

- 23 coronavirus (Covid-19)

- 276 VAT

- 96 Software

- 281 Tax

- 148 Bookkeeping

- 7.2K General accounting discussion

- 211 AAT member discussion

- 3.8K For everyone

- 38 AAT news and announcements

- 345 Feedback for AAT

- 2.8K Chat and off-topic discussion

- 589 Job postings

- 16 Who can benefit from AAT?

- 37 Where can AAT take me?

- 43 Getting started with AAT

- 26 Finding an AAT training provider

- 48 Distance learning and other ways to study AAT

- 24 Apprenticeships

- 67 AAT membership