Account for inventory

jacktar

Registered Posts: 7

Hello, Ive been trying to figure this out for ages and all the demonstrations I ve seen have been simple rounded numbers. I m new to accounting and can t get my head around this at all, any help would be appreciated.

Having a blank inventory, I make a purchase of £93.83.

Net £72.20

Shipping £5.99

VAT £15.64

Not being VAT registered would the total purchase be made with or without the VAT?

The purchase was for 50 t-shirts, 40 at 1.47 excluding vat and 10 at 1.34 excluding vat. what would be DR and CR and for what amounts? It s really confusing me!

Thanks in advance.

Having a blank inventory, I make a purchase of £93.83.

Net £72.20

Shipping £5.99

VAT £15.64

Not being VAT registered would the total purchase be made with or without the VAT?

The purchase was for 50 t-shirts, 40 at 1.47 excluding vat and 10 at 1.34 excluding vat. what would be DR and CR and for what amounts? It s really confusing me!

Thanks in advance.

0

Comments

-

Hi,

If NO VAT.

DR Purchases with 87.84

CR Creditors / PLCA or Bank 87.84

DR Carriage in 5.99

CR Creditors / PLCA or Bank 5.99

If VAT registered

Treat carriage in as above.

Dr Purchases 72.20

CR Creditors / PLCA or Bank 93.83

DR Purchase / Input VAT 15.64

0 -

Yes that's true.

Although both have the same net effect on COGS0 -

Thankyou for your post! I understand the postings to the GL in regards to double entry it's more the not understanding the posting of a purchase and including an inventory account for purchases and sales because of the different prices per unitBertie said:Hi,

If NO VAT.

DR Purchases with 87.84

CR Creditors / PLCA or Bank 87.84

DR Carriage in 5.99

CR Creditors / PLCA or Bank 5.99

If VAT registered

Treat carriage in as above.

Dr Purchases 72.20

CR Creditors / PLCA or Bank 93.83

DR Purchase / Input VAT 15.640 -

Hi,

I'm sorry I don't quite understand your question - if you expand a little I'll try to answer.0 -

Okay sorry. So on making a purchase for clothing we need to keep track on inventory coming in and out of the business. Its not as simples as £1 per unit so the inventory gets debit £1xunits for purchases and credited £1xunits as they're all different prices.Bertie said:Hi,

I'm sorry I don't quite understand your question - if you expand a little I'll try to answer.

0 -

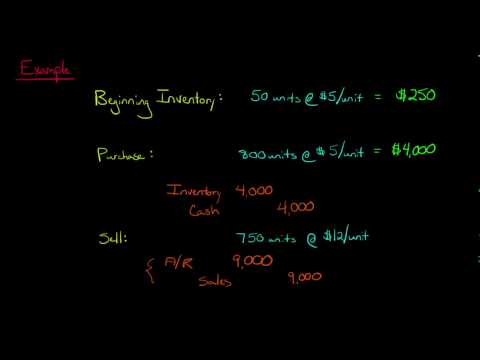

Bertie said:

Hi,

I'm sorry I don't quite understand your question - if you expand a little I'll try to answer. https://www.youtube.com/watch?v=30BoifG_904&index=5&list=LLrxUnCIPwQJdcP8Vc5C1S4g

https://www.youtube.com/watch?v=30BoifG_904&index=5&list=LLrxUnCIPwQJdcP8Vc5C1S4g

I'm watching this as this is how we want to do it, but as for our unit value it confuses me.

0 -

Hi, Jack??

I'm still lost at the question.

Is this in relation to an exam question or are you just being inquisitive? If it's a question, post the question.

When you say 'unit value confuses me' which do you refer to?

Is it the calculation of the figures you're stuck at or the entries?0 -

Hi, sorry I'm confusing you. I'm probably not using the correct terms.

Basically what I was confused about but I think I've figured it out now.

Was when making a purchase of clothing different clothing comes and different rates per unit (per item of clothing) therefore how would that be show when debiting inventory and crediting it when a sale is made. But after doing some more digging I've come across FIFO and persific ID number which can relate the the unit cost per item of clothing to then Cr inventory and debit COGS correctly. Would that be correct?0 -

Not knowing where you are with your studies makes it difficult to give an answer you will understand at this moment.

FIFO and average cost are the usual methods.

Periodic method is also the usual, as an oppose to perpetual method.

For a full understanding, again it does depend what level you are on, look into IAS 2.0

Categories

- All Categories

- 1.3K Books to buy and sell

- 2.3K General discussion

- 12.5K For AAT students

- 390 NEW! Qualifications 2022

- 174 General Qualifications 2022 discussion

- 16 AAT Level 2 Certificate in Accounting

- 78 AAT Level 3 Diploma in Accounting

- 114 AAT Level 4 Diploma in Professional Accounting

- 8.9K For accounting professionals

- 23 coronavirus (Covid-19)

- 276 VAT

- 96 Software

- 281 Tax

- 148 Bookkeeping

- 7.2K General accounting discussion

- 211 AAT member discussion

- 3.8K For everyone

- 38 AAT news and announcements

- 345 Feedback for AAT

- 2.8K Chat and off-topic discussion

- 589 Job postings

- 16 Who can benefit from AAT?

- 37 Where can AAT take me?

- 43 Getting started with AAT

- 26 Finding an AAT training provider

- 48 Distance learning and other ways to study AAT

- 24 Apprenticeships

- 67 AAT membership