PTC - Shares

Chrissiemartin1

Registered Posts: 18 New contributor 🐸

I am trying to work out the following can anyone explain how I do this

Transactions in the shares

Date no of shares £

April 1986 Purchased 300 3,000

May 1990 Purchased 500 8,500

June 1992 Bonus Issue 1 for 5

April 1995 Purchased 1,000 16,000

March 2004 Sold 400 7,600

In Jan 2008 we sold all shares for £65,000

I have to work out gain or loss after any taper relief made on disposal of shares if applicable.

Can anyone explain how I do this step by step cos I cant understand how they are doing it in the book

:crying:

Transactions in the shares

Date no of shares £

April 1986 Purchased 300 3,000

May 1990 Purchased 500 8,500

June 1992 Bonus Issue 1 for 5

April 1995 Purchased 1,000 16,000

March 2004 Sold 400 7,600

In Jan 2008 we sold all shares for £65,000

I have to work out gain or loss after any taper relief made on disposal of shares if applicable.

Can anyone explain how I do this step by step cos I cant understand how they are doing it in the book

:crying:

0

Comments

-

I found the best way to do it was with a table that you update with every transaction you make. Remember you need to do this with the 1985 pool.

Hope this helps if not message me and i will send you my notes on it.0 -

If you can send me your notes that would be great as I cant seem to get what it is saying in my book[/I]0

-

Im doing PTC too

Date no of shares £

April 1986 Purchased 300 3,000

May 1990 Purchased 500 8,500

June 1992 Bonus Issue 1 for 5

April 1995 Purchased 1,000 16,000

March 2004 Sold 400 7,600

In Jan 2008 we sold all shares for £65,000

FA 1985 Pool

Number Cost£ Indexed

Cost£

April 1986 Purchase 300 3000 3000

162.6-97.67 x 3000

97.67

Indexed allowance 1994

300 3000 4994

May 1990 Purchase 500 8500 8500

June 1992 Bonus issue 100

162.6-126.2 x 8500

126.2

Indexed Allowance 2452

900 11500 15946

April 1995 Purchase 600 9600 9600

162.6-149 x 9600

149

Indexed Allowance 876

Pool Totals 1500 21100 26422

Disposal (1500) (21100) (26422)

Pool Balance after disposals 0 0 0

Proceeds (1500 x £28.26) £65000

Less cost (£21100)

Less indexation (£26422 – £21100) (£5322)

Gain before taper relief 38578

60% chargeable gain based on 9 + 1 years

Workings

£65000 divided by total shares of 1500 = £28.26

I have put all the disposals and bonus issue of shares before April 1998 into the FA

1985 POOL table

I have only added 600 shares purchased for April 1995 because 400 of them were sold in March 2004

Disposal of 400 shares in March 2004

Proceeds (for 400 shares) £7600

Less cost (16 x 400) (£6400)

Less indexation (£582.4)

Gain before taper relief 617.6

80% chargeable gain based on 3 years

Workings

162.6 – 149

149

the cost price of the 1000 shares bought for £16000 in April 1995

which is £16000 divided by 1000 gives you £16 per share

Multiply the £16 by 400 shares to give you £6400

Capital Gains Tax payable

Gain with 80% chargeable £617.6 x 80% £494.08

Gain with 60% chargeable £38578 x 60% £23146.8

£23641

Less annual exempt for 07/08 (9220)

Amount subject to Capital Gains Tax 144210 -

koolboi2007 wrote: »I have only added 600 shares purchased for April 1995 because 400 of them were sold in March 2004

You can't do that.

The 400 sold in March have to come from the pool; they can't be specifically identified against any of the previous purchases.

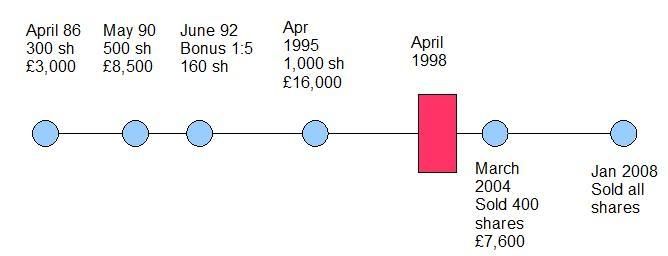

First place to start with any shares & securities question is a timeline; at one end you have the initial purchase, at the other the final transaction, and in the middle mark April 1998 so for the question in the original post, you would have something like this:

Once we've done that, we now check the share matching rules and apply them to the scenario.

1. Same day acquisitions - none

2. Acquisitions in the following 30 days on a FIFO basis - none

3. Acquisitions after 6-4-98 on a LIFO basis - none

4. FA1985 pool - shares acquired between 6-4-82 and 5-4-98 (also known as Section 104) - Yes

Once that's done, we set up the FA1985 pool.0 -

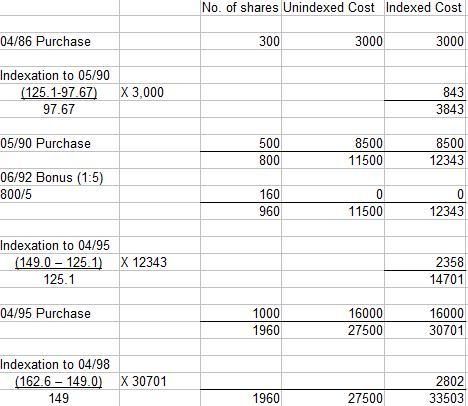

The FA1985 pool

General

- The pool is made up of three columns: 1) No. of shares, 2) Unindexed cost, and 3) Indexed cost.

- Once the pool is set up with the initial transaction, every operative event will give rise to indexation. Also, as indexation finishes in April 1998, shares must be indexed to then.

- An operative event occurs whenever shares with a value enter or leave the pool.

- We must first index up the indexed column from the time of the last rise before adding or subtracting value to or from the pool.

Bonus and Rights issues

- A bonus issue is not an operative event. Only the number of shares is increased, no money is paid for acquisition.

- A rights issue is an operative event as money is paid for the shares.

The FA1985 pool for this scenario (up to April 1998) would look like this (all figures to nearest £):

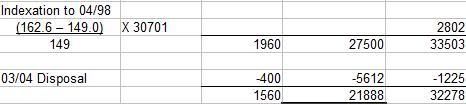

We now have to do the calculations for the 2004 disposal of 400 shares. The cost and indexation is based on an average of the final pool totals:

- the cost of the shares equals £5,612 (£27500/1960 shares owned, then multiplied by the 400 sold)(to nearest £)

- the indexation allowance is calculated by firstly calculating the indexed cost of the 400 shares disposed, which is £6,837 (£33503/1960, multiplied by 400), then deducting the cost from this (£5,612) to give you £1,225.

The gain on this sale therefore is:

Proceeds = 7,600

Less Cost = (5,612)

Less I. A. = (1,225)

GAIN BEFORE T.R = 763

There are 5 complete years between April 1998 and March 2004, plus 1 bonus year as the assets were owned before the removal of Indexation Allowance was announced, therefore the gain is 80% chargeable, based on 5 + 1 years.

Gain after Taper = £610

We now adjust the bottom of the FA1985 pool as follows:

As we are now selling all shares, simply take the figures from the bottom row and put them in your computation

Proceeds = 65,000

Less Cost = (21,888)

Less I. A. = (10,390)

GAIN BEFORE T.R = 32,722

There are 9 complete years between April 1998 and January 2008, plus 1 bonus year as the assets were owned before the removal of Indexation Allowance was announced, therefore the gain is 60% chargeable, based on 9 + 1 years.

Gain after Taper = £19633

Finally, you would deduct these from your pool, leaving a final line of zeroes as all shares are sold.0 -

Now I am confussed ;o(0

-

I agree with mehmet on this. The 400 shares bought have to be deducted from the pool. No shares were "bought" after Apr 98 so there is no need to do any LIFO matching of shares to work out the seperate gains for the amount of shares seperately bought. And mehmet that is a brilliant answer and diagram. In fact I've printed it out as it's very well explain. Thanks for your workings.0

-

After a pm from Chrissie, it has come to my attention that some people may not be able to see the pictures in my post.

If this applies to you, please email me at mehmetzemin@googlemail.com and I will forward them to you.0

Categories

- All Categories

- 1.3K Books to buy and sell

- 2.3K General discussion

- 12.5K For AAT students

- 390 NEW! Qualifications 2022

- 174 General Qualifications 2022 discussion

- 16 AAT Level 2 Certificate in Accounting

- 78 AAT Level 3 Diploma in Accounting

- 114 AAT Level 4 Diploma in Professional Accounting

- 8.9K For accounting professionals

- 23 coronavirus (Covid-19)

- 276 VAT

- 96 Software

- 281 Tax

- 148 Bookkeeping

- 7.2K General accounting discussion

- 211 AAT member discussion

- 3.8K For everyone

- 38 AAT news and announcements

- 345 Feedback for AAT

- 2.8K Chat and off-topic discussion

- 589 Job postings

- 16 Who can benefit from AAT?

- 37 Where can AAT take me?

- 43 Getting started with AAT

- 26 Finding an AAT training provider

- 48 Distance learning and other ways to study AAT

- 24 Apprenticeships

- 67 AAT membership