Jimmy Carr!

mrb82

Registered Posts: 147 Beyond epic contributor 🧙♂️

I'm really surprised Mr. Carr hasn't been mentioned on here yet!

I'm intrigued, what are all of your thoughts on this issue of tax avoidance?

I'm intrigued, what are all of your thoughts on this issue of tax avoidance?

0

Comments

-

I actually think that it's quite unprofessional of the Prime Minister to say what he has said, and in making such a personal attack. I could understand it if Jimmy Carr were an MP, but he isn't.

If Jimmy Carr has taken professional advice and what he has done is within the law then it is the law/Government at fault, not the individual.

I did wonder if Jimmy Carr would have a case for defamation?

Those are only my private wonderings; doubtless others will have different viewpoints!FMAAT - AAT Licensed Member in Practice - Pewsey, Wiltshire0 -

I did wonder if Jimmy Carr would have a case for defamation?

Surely that would involve a court deciding whether what he did was actually 'immoral' or not and by extension, raise potentially tricky questions in open court? Probably not a good course of action for anyone who may have stuff they don't want becoming public knowledge. It also wouldn't serve his public reputation as a comic of the ordinary person if he were "cleared". I can't imagine the K2 or Icebreaker avoidance schemes would fancy their chances either in a highly public case rather than (I'd imagine) a relatively closed shop case versus HMRC.

I personally thought David Cameron, while maybe a little misguided about speaking in the heat of the moment, was spot on about the hypocrisy of Carr's much less wealthy fans having to pay their own taxes while a multi-millionaire avoids his.

I get more enraged by flashy football clubs who avoid/evade taxes so they can attract players they can't afford in the hope of ensuring success to hopefully repay the debts they've accrued. It cheats their financially responsible rivals and the fans who pay to watch (but probably don't care anyway). The FIFA/UEFA financial fair play rules are long overdue and Rangers, Portsmouth etc are all fully deserving of their inevitable liquidations.

And did we ever get a satisfactory answer as to why Mr Redknapp's dog had £190,000 or whatever it was paid into it's Monaco bank account?0 -

Hi

I dont usually get involved in politics, but this issue did get me thinking.

I actually thought the PM's (and any other comment originating from Westminster) were rather hypocritical. Putting aside the issue of MP's being able to have and extra more than adequate home at the tax payers expense (but that's not a debate for here and now!), these tax avoidance schemes have been going for years and have been/are used by people with wealth very much in excess of Jimmy Carr (or Gary Barlow). If it's such an issue for those in Westminster, why is it only now that they have chosen to be so public? Probably (in true politician style) because they now have a band wagon on which to stand and shake their sticks, where as previously it wouldn't have served there purpose to speak about it!

Neil0 -

I too thought this would have been mentioned on here before now!

I feel quite sorry for Jimmy Carr being made a scapegoat for all of this. His personal tax affairs shouldn't have been made public anyway, and he's certainly not the only one doing what he's doing, but Mr Cameron has conveniently decided to shut up about it all now it's getting too close to home. At the end of the day, tax avoidance is legal, so I have no problem with him doing what he did and can't believe everyone who's getting at him over it. At the end of the day, how many of those people wouldn't want to pay less tax? And a lot of those people are probably 'guilty' of tax avoidance themselves on a much smaller scale, without even realising it - saving in an ISA, paying into a pension, buying DVDs from Jersey etc. I can understand people's annoyance at the loophole in the law that's allowed him to do this, but that is an issue with Parliament and the MPs, not with Jimmy Carr.

I think Parliament should be focussing much more on those who commit tax evasion, but they know they stand little chance of catching those, so have drawn all public attention to Jimmy Carr instead, who actually hasn't done anything wrong. And at the end of the day, the majority of the public probably don't even know the whole story anyway (I don't even know how the K2 scheme actualy works!) and are only hearing what Parliament/the press want them to hear.0 -

Rozzi Rainbow wrote: »I don't even know how the K2 scheme actualy works!)

Stolen from another website because this is the simplest explanation I have seen of the scheme...

UK earners 'quit' their job

They then sign new employment contracts with offshore shell companies

The offshore companies 'rehire' their new employee to the UK but take their earnings

The offshore company pays the employee a much lower salary each month, but 'loans' them several thousand pounds

These loans can be written down as tax liabilities, thus substantially reducing tax payable to the Government0 -

I agree with the hypocrisy shown by Dave C.

From my own point of view, Jimmy has not done anything wrong, and Joe Public getting outraged by someone keeping their wealth, I believe, is just because they are unable to do so themselves. If they were high earners paying little tax legally, they wouldn't see a problem with it.

What I admire about Jimmy is the fact he came out and apologised, and on 8 Out Of 10 Cats, took everything that went his way. He appeared genuine and looked as though he has had a rough time.

What are your views on this as accountants though? Surely this is a good example of PEAF if ever there was one!0 -

...Joe Public getting outraged by someone keeping their wealth, I believe, is just because they are unable to do so themselves. If they were high earners paying little tax legally, they wouldn't see a problem with it.

I'm inclined to agree with the above comment.

On the issue of ethics, it’s always down to appoint of view (what’s ok in one person’s eyes, isn’t in another’s), and where doe the line get drawn between word of law and spirit of the law…?. Also, who is the accountant ethically accountable to, doing the best for his/her client or what is best in the eyes of society?0 -

What I admire about Jimmy is the fact he came out and apologised, and on 8 Out Of 10 Cats, took everything that went his way. He appeared genuine and looked as though he has had a rough time.

I agree with 8 out of 10 cats, thought he did the show very well on Friday to openly discuss what had happened and let the others make jokes at his expense (unlike a certain Mr Cowell who tried to pretend nothing had happened when all the scandals in his book came out) but I don't think he had anything to apologise for at all.0 -

It's naive to say that if it's legal then it's okay since we all know that legality and morality are not always the same thing. IMO, there's a huge morality difference between "paying your fair share" and barely paying anything at all, even if it is within the current laws. And just because it's legal now, doesn't mean it'll remain that way and that the taxman won't come after you once the dust has settled (assuming any legal decision does go his way).

I'd love to ask Glasgow Rangers if their tax avoidance schemes were worth it and whether they now feel their accountants acted in the best interests of the client. Do you think any accountant who chooses to operate in the dangerous grey area between what's legal and what might not be, is acting ethically? If lawyers acted this way, we'd undoubtedly label them as "immoral" or even "crooked", yet how come, as accountants ourselves, we subjectively view our profession differently?0 -

It's naive to say that if it's legal then it's okay since we all know that legality and morality are not always the same thing. IMO, there's a huge morality difference between "paying your fair share" and barely paying anything at all, even if it is within the current laws. And just because it's legal now, doesn't mean it'll remain that way and that the taxman won't come after you once the dust has settled (assuming any legal decision does go his way).

I'd love to ask Glasgow Rangers if their tax avoidance schemes were worth it and whether they now feel their accountants acted in the best interests of the client. Do you think any accountant who chooses to operate in the dangerous grey area between what's legal and what might not be, is acting ethically? If lawyers acted this way, we'd undoubtedly label them as "immoral" or even "crooked", yet how come, as accountants ourselves, we subjectively view our profession differently?

Hmmm I think before having a pop at the accountant ask yourself these questions:

* If it's legal should I explain this to my client?

* Would my client expect me to tell him about it?!

* What if I decided not to tell my client and he hears about the 'scheme' from a mate down the pub?

* Will he bring a PI claim against me for not telling him?

We advise clients' based on the law and within the law. We are agents of the client and take instructions as such. They have to ultimately decide what to do - we can only but guide.

A partner in a "large accountancy" firm who wishes to remain un-named said it best - "we're damned if we do, we're damned if we don't!"

My view is that DC is totally in the wrong for making JC the scape goat!

Regards0 -

Hmmm I think before having a pop at the accountant ask yourself these questions:

* If it's legal should I explain this to my client?

* Would my client expect me to tell him about it?!

* What if I decided not to tell my client and he hears about the 'scheme' from a mate down the pub?

* Will he bring a PI claim against me for not telling him?

We advise clients' based on the law and within the law. We are agents of the client and take instructions as such. They have to ultimately decide what to do - we can only but guide.

A partner in a "large accountancy" firm who wishes to remain un-named said it best - "we're damned if we do, we're damned if we don't!"

My view is that DC is totally in the wrong for making JC the scape goat!

Regards

The above follows my train of thought. True, the ethics of the accountant are in question for advising the scheme but I think Mr Carr is probably wise enough to read between the lines and appreciate that people may frown on drastically cutting tax on a large income. To reiterate, Westminster is just using the situation as a band wagon, if the powers at be are as concerned about these matters as they have claimed to be in recent press, why have they taken so long to be so publicly vocal about it?

Neil0 -

We advise clients' based on the law and within the law. We are agents of the client and take instructions as such. They have to ultimately decide what to do - we can only but guide.

I can see I'm on my own here, and while technically I agree with you, I'm afraid that just won't wash. Clients and certainly non-practice employers take their accountant's word and expertise on total trust - perhaps misguidedly so at times - and wouldn't expect future repercussions. And again, there will undoubtedly be unethical accountants who won't necessarily explain - or even disclose at all -the potential risks associated with certain schemes.

And what exactly should David Cameron have said when put on the spot in an interview on a breaking news story? "Personally, I fully support tax avoidance schemes, can't have enough of 'em and I myself am delighted that I only paid a couple of grand myself last year on my six figure income?" Alternately, he could have given no answer at all to which the common man in the street might still have seen as a 'fifth amendment' endorsement. He isn't out to win the hearts and votes of accountants or the less than one nano-percent general population of the super wealthy...

As you stated Dean... he's damned if he does, damned if he doesn't...0 -

Clients and certainly non-practice employers take their accountant's word and expertise on total trust - perhaps misguidedly so at times - and wouldn't expect future repercussions.

Isn't this the Harry Redknapp defence ? ( And in answer to an earlier post, I've no idea how his dog came to have several millions offshore !)And what exactly should David Cameron have said when put on the spot in an interview on a breaking news story?

When questioned by the press in 2010 about Phllip Greenes tax avoidance Mr Cameron said that the government do not comment on the tax affairs on individuals. I imagine that same sentence would have worked just as well in this situation.

Then again, it is a bit rich of Mr Carr to make money from comic sketches berating Barclays for only paying 1% tax via offshoring tax avoidance schemes, to put his pay for such observations in to an off shore tax avoidance scheme.0 -

I love Jimmy Carr as a comedien, but do agree that he was at best foolish to go along with it, and hypocritical do do the Barclays advert. However, how did this become public knowledge? And why is it ok to publish the tax affairs of a 'private individual' companies have to publish their tax affairs, jimmy car doesn't. I can understand the public interest aspect to a degree, but as its been said online a lot recently that the amount of tax jimmy avoided is nothing compared to Vodaphone and Topshop etc. surely what they are doing is immoral and probably illegal too. A lot more so than Jimmy Carr.0

-

Here's an interesting tweet (via @Glinner)...

The Sun on Jimmy Carr http://bit.ly/MHXLLd The Sun on One Direction http://tinyurl.com/cb2dasz0 -

I discussed this on my facebook.

Sorry - lots of words, but these are my thoughts (cut and pasted so a bit disjointed)

Paying taxes is only a moral responsibility when the government uphold their moral responsibility to use taxpayers' money wisely.

As a tax advisor, my argument is that if the government really wanted the rich to pay their share, they would close down the loopholes that allow large scale tax avoidance. They don't do it. Why? Because they themselves benefit. It's the hypocrisy of Cameron criticising the likes of Jimmy Carr that annoys me.

It's all about scale, too. Broadly speaking, I save every limited company client I look after about £2000 a year in "standard" tax avoidance that "everyone" does. Let's say I have 100 clients. That's £20,000. I'm one accountant. How many accountancy firms are there in the UK? EVERYONE does things to avoid tax. Multiply that by the number of people - that's far more than Jimmy Carr. And speaking of far more than Jimmy Carr....

I can't see me ever getting involved with complex high-end tax avoidance schemes. But as someone who helps people avoid tax at a low level every day by exploiting all the tax laws in ways the profession uses as standard, I really don't feel I can get my knickers in a twist with people doing it in a different way. Low salary-high dividends is legal tax avoidance. Sure, it's mainstream and not high-end convoluted tax avoidance, but it's still tax avoidance. All my clients are in a position to avoid tax - that's what they pay me for. Sure, we call it "paying the right amount of tax" but paying a professional advisor to use all the rules to minimise their tax bill is avoidance.

Furthermore, and I know everyone is different, but many rich people do a lot for charity. And also buy luxury goods, which have VAT on them and then have CT paid on them by the retailer. So I'd be interested to know what the actual net loss to the government/ society is after actually taking it into account.

I also think that if the average person who is on PAYE and thus has little scope for tax avoidance methods was in the position of having a business, or a personal fortune, then can they honestly say they wouldn't do anything to mitigate their tax liability? Sure, some people would pay UK tax without getting complicated and 'immoral' but I'm sure plenty would suddenly quite like the varying schemes on offer should they suddenly find themselves in a position to utilise them. As I said above, it's the hypocrisy that gets me.

Until the government stop paying needless quangoes, excessive expenses and other questionable budgetary items, it's not right to accuse tax avoiders of damaging the NHS or Education, when we can't trust the Govt to allocate money correctly in the first place.

It's not as simple as pure ethics. I'm also pretty sure that as long as any tax avoided stays in the UK, it gets to the government's coffers eventually anyway.

I think we all agree that everyone needs to pay tax so we can all enjoy said public services. I'm sure Carr, Barlow, Cameron and others all pay far more tax than we ever do, even with a bit of tax avoidance. The "fair share" argument then comes into play, which is when I trefer back to the government's morality in sharing out the money.

What if the tax avoided got given to charity? Or bought a new Aston Martin (think of the tax on that, and the subsequent tax take on fuel, and insurance premium tax)? Or spent on luxury goods (more tax). And all the profits of the businesses who receive this avoided tax will have to pay tax on their profits (some who will do a Philip Green, others who will pay UK tax). Arguably, if one pays the tax, one can't pay the extra tax on all the things that money is spent on. And that money will have interest received on it (likely taxable). More interest than if the tax had been paid. So it really isn't as cut and dried as "he avoided paying tax he should have" because of the way society is taxed in general. A multi-million home will have to pay council tax, will have had stamp duty paid on purchase, and the seller may have had to pay capital gains tax on it.

I didn't elect the current government, and I didn't elect the last lot, either. I don't agree with many of their laws, policies, or how they spend some of my tax money. I don't agree with them, so I choose to spend less tax with them if I am able. I can't fault someone for that, even if it's via a loophole. *If they then do not distribute the extra money to UK economy and/or charity, that is the point where my moral outrage kicks in* and not a step before.

I don't like banks, but don't have a problem with Jimmy Carr, is because banks make money from screwing people over. Carr makes money from working hard to make people laugh. We made him rich, sure, but he earned all that money by being talented. If he is socially irresponsible with the extra money he's got as a result of an avoidance scheme (and I will probably never know the answer to that) then at that point I will quite happily badmouth him along with the bankers.

"even if only 1% of the tax avoided went to the NHS, think what that could buy?"

Lots of good stuff. But what is the morality of paying money knowing 99% will be squandered, spent on "duck houses," unnecessary quangos, jolly lunches, etc. Should we continue paying good money to bad places just so they can hand the scraps to the things we really want them to spend money on? Arguably there is a moral stance of saying "screw your taxes, I will give money directly to my local school and NHS trust, because I don't trust you to get it there if I give it to you first." Now quite obviously we can't all go evading taxes to do that. But if that argument was applied to tax avoidance, it might not be such a big deal. This of course brings me back to my "spending his extra money responsibly" stance on Mr Carr and others in his position.

So, the moral argument is about generally being socially responsibly with money; paying taxes does not automatically flow from this, if other steps are taken to compensate.0 -

Here's an interesting tweet (via @Glinner)...

The Sun on Jimmy Carr http://bit.ly/MHXLLd The Sun on One Direction http://tinyurl.com/cb2dasz

Like I said - it's the sheer hypocrisy of it that pisses me off.0 -

I do understand what you're saying Miss Frost, and yes there's widespread hypocrisy, but pragmatically, we have to learn to ignore many of the the faults of government. They can't act against all tax avoiders, evaders or many other forms of grey area immorality/crime buf if they can only catch a few and close the loopholes that absolutely need to be closed in the nation's best interests, then isn't that action justified? You can't catch and imprison all drug dealers either but if government took no action whatsoever and turned a complete blind eye, where would we be?

I read a story that some tax avoiders are only paying £3,500 per year tax on a £288,500 annual income. If they'd paid say £50-75k tax on that, you might justifiably argue fair share but I don't think anyone could say £3,500 is moral and helps contributes to the nation's coffers. I agree with you that if money is re-spent in the country where it's earned - as opposed to being shipped abroad where we never see any benefit - and it flows back through the nation's cash cycle then that's maybe a mitigating factor but it's not an argument that totally exonerates outrageous tax avoidance.0 -

JaffasGirl wrote: »However, how did this become public knowledge? And why is it ok to publish the tax affairs of a 'private individual' companies have to publish their tax affairs, jimmy car doesn't.

I'd imagine many celebrities incorporate themselves into limited companies with several employees and their records are publicly available like any other company.0 -

if money is re-spent in the country where it's earned [...] and it flows back through the nation's cash cycle then that's maybe a mitigating factor but it's not an argument that totally exonerates outrageous tax avoidance.

I will agree to disagree on that one, for my longwinded reasons stated above! If it is LEGAL and the person is socially responsible with their money, I couldn't care less how much tax they avoid.

I agree, K2 and similars do take the piss (and yes £3.5k on 6 figure sums is not fair share at all), but it's legal. As soon as they fritter that money abroad and/or do nothing to help society after avoiding large amounts of tax, well then I will quite happily criticise them because for me that's the crux of the issue.0 -

I personally thought David Cameron, while maybe a little misguided about speaking in the heat of the moment, was spot on about the hypocrisy of Carr's much less wealthy fans having to pay their own taxes while a multi-millionaire avoids his.

I thought the same there.

Initially I thought Cameron should have concentrated on closing these loop holes rather than talking about them, but it will have scared a few high profile people doing the same!

** Just properly read through the thread, some good points made for both sides, you can put a good argument either way.

When I think about whats morally right, I could argue for tax efficiencies, paying yourself through dividends, employing a spouse etc, but I find it hard to argue reducing your tax bill by such a huge margin, and thats obviously what Jimmy thought when he held his hand up and apologised.

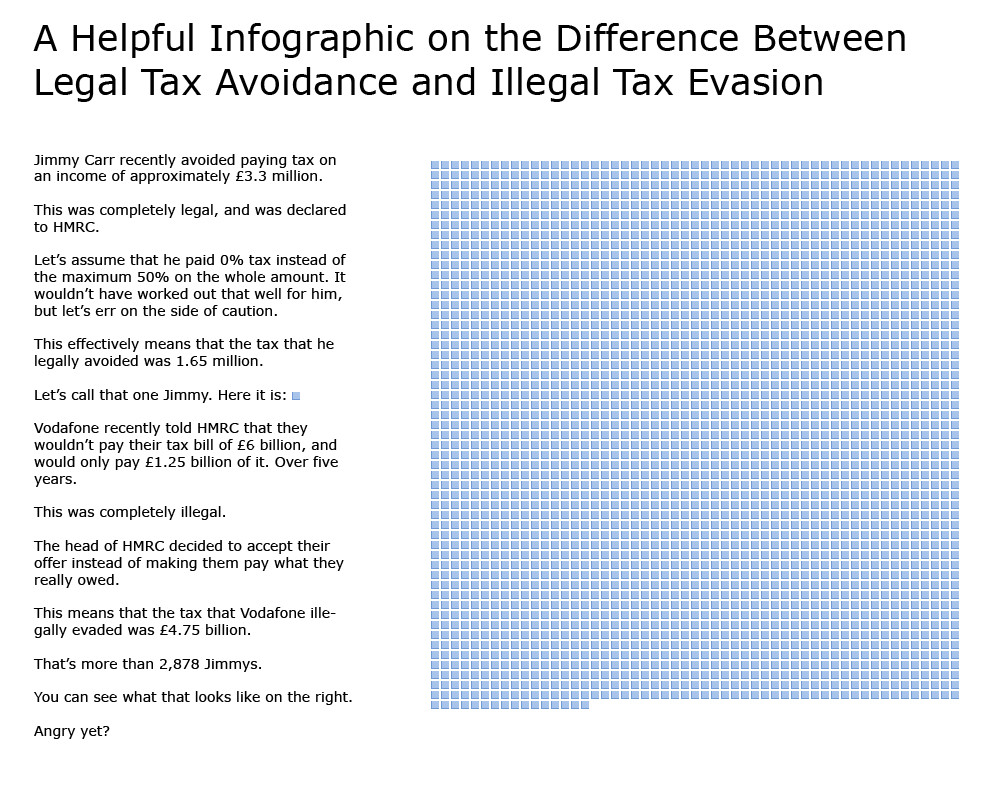

The Vodafone coparison above is very good, however you could argue that the other way and split the tax saving over all their employees, directors, shareholders - and I'd guess it'd then somewhat less than Jimmys.0 -

Moral or not.

I'm guessing that the government is probably trying to push through some kind of 'orrible legislation that nobody will like while trying to distract everyone by saying "Look at what Jimmy Carr has done!"

We'll all wake up tomorrow and find that they've introduced a tax on laughing or something.0 -

Moral or not.

I'm guessing that the government is probably trying to push through some kind of 'orrible legislation that nobody will like while trying to distract everyone by saying "Look at what Jimmy Carr has done!"

We'll all wake up tomorrow and find that they've introduced a tax on laughing or something.

+1 to that 0

0 -

Well for what it's worth, I've seen Jimmy live a couple of times in the past and am again in November! It's worth the price, so as long as he's not using the money to fund drugs for kids I don't care what he does with my ticket fee!0

-

...so as long as he's not using the money to fund drugs for kids I don't care what he does with my ticket fee!

You could also argue that by extension, by his and others avoidance of tax, they're also not contributing their 'fair share' to a support system that the poorer majority of the country rely on. They might not be supplying drugs to kids but in absolute contrast, they're also not supplying the help to those same kids that might be desperately needed. And it's not just drugs, it could be anything. For example, a life saving piece of equipment that an NHS hospital can't afford and has to rely on charity and fund raising. And there come the double standards: as accountants, we might gladly help someone avoid tax because it's our job and it's how we get paid ourselves: yet by the same turn, we're helping deny the collection of (fair share) taxes that would help purchase that equipment in the first place. As ordinary people we're naturally enraged and as accountants we're partly responsible for the system that cannot buy it!

I have no quantifiable stats here so will just go with the theory. Let's say 60-80% of the total tax collected by central government is generated by just five percent of mega salary wage earners and huge corporations. (I've seen similar statements made before against alleged corporation tax avoiders so I'm not completely talking out of my arse.) Now if one percent of those then decide to employ tax avoiding tactics, wouldn't the remaining 95% of tax payers then be squeezed to somehow make up the shortfall? This is how it works in other financial walks of life so I can't imagine tax is overly different.

So to say tax avoidance doesn't affect the rest, IMO, isn't necessarily correct.

I've also seen Jimmy Carr live but not entirely sure what I think of him at the moment. Selfish prick probably...0 -

Well i was actually being tounge in cheek but... maybe I'd care if I actually thought the current UK political system and its government (and other parties) were actually something i could get behind...

At any rate, if the figures quoted are anything to go by, he still pays more tax than I do!0 -

Just to throw in a very close minded view; I love Jimmy Carr as a comedian, hes great at his work. The fact he has legally screwed the system, people obviously think its unfair.

I don't know anyone who wouldn't do the same if they could? Everyone can play the moral arbiter of society on such issues but with a bit of empathy they're exactly the same.

I'm going to be in favour of Jimmy more than that of a politician due to personal preference and most politicians not having souls. Jimmy Carr is probably a small fish in all of this as the comparison above shows.

I'm surprised nobody has played more on the fact that it is legal, his accountant is doing his job and hes done it very well. Ethical? I wouldn't say its ethical, but i wouldn't slate him for it, its not directly impacting anyone, it may have knock on effects sure but thats not entirely in his forethought or his problem.0 -

So to say tax avoidance doesn't affect the rest, IMO, isn't necessarily correct.

I'm with you Blobby.

I'm sure some accountants would refuse to use schemes like K2 because of their moral stance, or maybe because they don't believe its within the spirit of the rules, a term often used with our accounting principles.

There's fine line between this K2 scheme and the black market, obviously a big difference legally but the moral difference is very small. I could argue I'm working "cash in hand"; spending the money ethically, spending it in the UK, but it still leaves me with more cash to spend than someone with a straightforward tax system, and I doubt my argument would go down well with them!0 -

When everyone is referring to immorality, are you saying its immoral due to it not being fair? I think immoral is a bit over-exagerated personally.0

-

James Patterson wrote: »When everyone is referring to immorality, are you saying its immoral due to it not being fair? I think immoral is a bit over-exagerated personally.

With ethics and morals everyone will have a different take on it. Although it was pretty obvious where the general public feeling was.0

Categories

- All Categories

- 1.3K Books to buy and sell

- 2.3K General discussion

- 12.5K For AAT students

- 390 NEW! Qualifications 2022

- 174 General Qualifications 2022 discussion

- 16 AAT Level 2 Certificate in Accounting

- 78 AAT Level 3 Diploma in Accounting

- 114 AAT Level 4 Diploma in Professional Accounting

- 8.9K For accounting professionals

- 23 coronavirus (Covid-19)

- 276 VAT

- 96 Software

- 281 Tax

- 149 Bookkeeping

- 7.2K General accounting discussion

- 211 AAT member discussion

- 3.8K For everyone

- 38 AAT news and announcements

- 345 Feedback for AAT

- 2.8K Chat and off-topic discussion

- 589 Job postings

- 16 Who can benefit from AAT?

- 37 Where can AAT take me?

- 43 Getting started with AAT

- 26 Finding an AAT training provider

- 48 Distance learning and other ways to study AAT

- 24 Apprenticeships

- 67 AAT membership